It’s the 2025 planning season for companies on a calendar fiscal and if you’re like most CRO’s / CFO’s, you’re stuck in a top down & bottoms up ExHell sheet that only Dante himself would be envious of.

I’ve seen a lot of mistakes in models like this, after all, it is just a forecast and we’re all human, but the biggest mistake that I see in these types of projections is this:

Companies don’t anticipate - or grossly underestimate - their sales cycle.

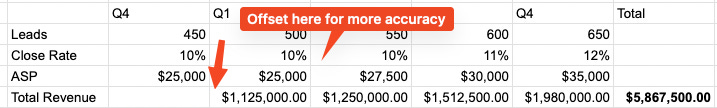

What typically happens in a planning cycle is a slightly more complex version of something like this:

Everyone looks at this and pulls a muscle high-fiving each other because of all that sweet, sweet money that is going to come in.

This model works great if you can close your deals in a single call, but most SaaS organizations don’t do this. Most companies have a 60 - 90 day sales cycle (or longer) and as a result, even in this rudimentary model above, you’re going to miss your numbers.

And you’re going to miss in Q1, which no one ever wants to do because no matter what you do, you can never dig yourself out of the hole. You’re always going to be a quarter behind after that first miss.

For example and for easy math, let’s say that the company above has a 90-day sale cycle. Unless 100% of those 500-leads mentioned above come in on the first day of the quarter, this company is going to miss their Q1 number.

Leads that come in in January, close in April. Leads generated in February, close in May and so on. It’s simple math that so many companies gloss over.

Worse, and I’ve seen this movie plenty of times, let’s say that they have a big event that they are counting on in the 3rd month of the quarter to generate a big chunk of these 500-leads, well that is all well and good, but none of those leads are going to turn into deals until late in Q2.

Great, demand gen makes the number (they did get the 500-leads after all), but the quota carriers are going to miss by a mile.

The result is that companies that forecast like this will always be 1-quarter behind. I’ve talked about it so much that a CFO friend calls it “Schnaars Law”. Big companies, small companies, and all companies in between, don’t do the math on sales cycles and as a result, they miss the number in Q1.

A more accurate way to do this is to look at what you’re going to do in Q4 and extrapolate that out to Q1. Again, super simplified:

This company will generate 450 leads in Q4 of this year, which will result in 10% of those closing in Q1 of next year (90-day sales cycle and all).

Sure, some deals could close in quarter, but if you’ve got a 90-day sale cycle, it’s hard to argue the math and most of those deals will close in Q1.

In this example, you’re going to roll up a number that is $1.6MM shorter than the original model, but it is more accurate. You’ll be more confident in what you roll up to your board and you’ll be more confident in your spending for the year.

Your job as a leader is to push your team to deliver more, but it is also to be as honest and accurate as possible with your leadership and investors. Nothing scars that more than a bad forecast right out of the gate.

I’m working on something new. If you’re a venture funded, SaaS CEO with between $5MM and $20MM in ARR looking to scale your sales team quickly, I might have an answer for you. If anything, I’d love to get your feedback on what I’m working on. DM me.